Labor advocates have been feeling their oats currently, what with a surge of profitable union organizing drives at Starbucks shops, the trace of union curiosity at Amazon warehouses, larger minimal wage requirements in cities and states throughout the nation, and a nudge up of common wages throughout the board.

These tendencies have impressed some to proclaim the arrival of a brand new period of employee energy.

“The labor market is experiencing a Nice Improve,” the progressive Roosevelt Institute declared in February.

Most indicators present both declining labor energy or give combined alerts.

— Teresa Ghilarducci, New Faculty

“We’re in a second the place, politically, employees are ascendant,” David Madland of the Middle for American Progress, a liberal assume tank, instructed the funding publication Barron’s in Might. (The article’s headline learn: “How Employees Gained an Edge — and Why They Gained’t Lose It Quickly.”)

Sadly, this form of confidence could be a drug that invitations harmful overdoses. That’s the view of economist Teresa Ghilarducci of the New Faculty.

E-newsletter

Get the newest from Michael Hiltzik

Commentary on economics and extra from a Pulitzer Prize winner.

Chances are you’ll sometimes obtain promotional content material from the Los Angeles Instances.

Ghilarducci lately compiled a roster of financial indicators suggesting that employees haven’t gained as a lot leverage as a superficial examination would possibly recommend. Even the advances to this point, corresponding to they’re, nonetheless depart miles to journey earlier than the American working class recovers all of the financial standing it has misplaced for the reason that Nineteen Seventies.

“Lots of the speak about labor having energy is predicated on organizing efforts at Starbucks and Amazon,” Ghilarducci instructed me. Of 11 financial indicators she examined, she says, “most indicators present both declining labor energy or give combined alerts.”

Ghilarducci is just not aiming to be a killjoy only for the hell of it. The situation of the labor market is critically essential as a result of the Federal Reserve Board is satisfied that the tight labor market is a vital issue driving inflation larger. Consequently, its inflation-fighting strategy includes kneecapping employee bargaining energy.

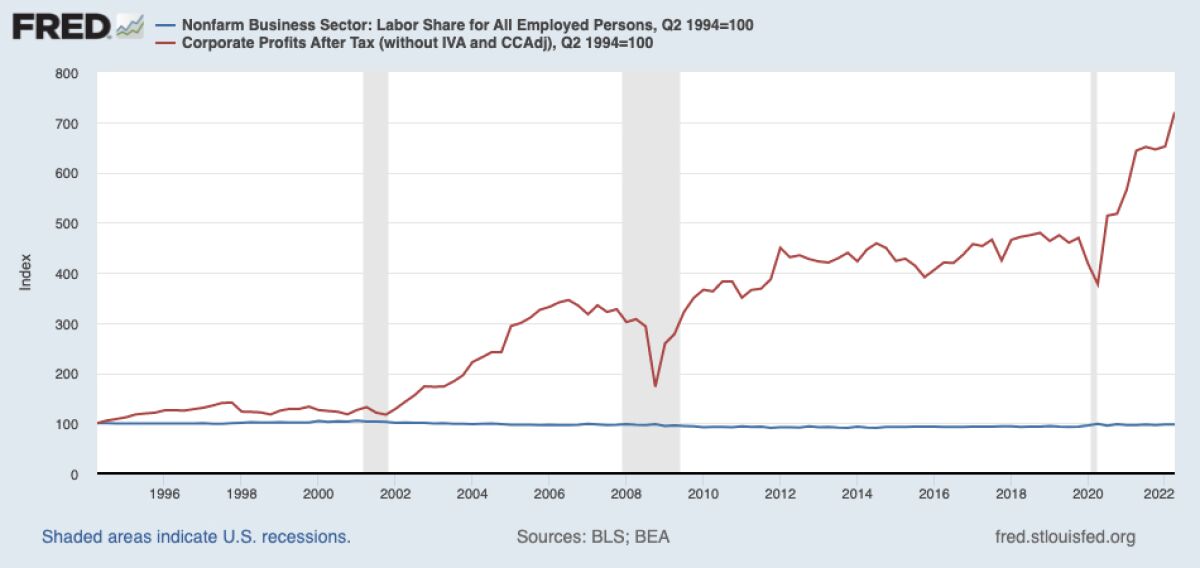

Who’s obtained the ability? Company earnings (pink line) have grown sevenfold since 1994 — and sooner for the reason that pandemic — whereas labor’s share of the economic system (blue line) has stagnated.

(Federal Reserve Financial institution of St. Louis)

Fed Chairman Jerome H. Powell has explicitly acknowledged that unemployment should rise for inflation to return down. “The labor market has remained extraordinarily tight,” Powell mentioned at his Sept. 21 information convention following the Fed’s month-to-month determination to boost rates of interest by three-quarters of a % for the third time in a row.

As proof for the tight labor market, Powell cited “the unemployment price close to a 50-year low, job vacancies close to historic highs, and wage development elevated … with demand for employees considerably exceeding the provision of obtainable employees.” He concluded, with evident remorse, “Up to now, there’s solely modest proof that the labor market is cooling off.”

But if the labor market hasn’t been tight sufficient to supply employees with actual good points in wages and residing requirements, the Fed’s strategy threatens to remove the lackluster good points they’ve achieved within the final 12 months.

So let’s study what has actually been occurring on the labor entrance.

An important indicator is wage development. Though pay has been rising, wages have been outstripped by value inflation. In uncooked phrases, common nonfarm hourly wages rose by 5.2% within the 12 months resulted in August, in keeping with the Bureau of Labor Statistics. In actual phrases, nonetheless — that’s, accounting for inflation — they fell by 2.8% in that interval.

The Fed’s strategy is predicated on an financial idea referred to as the Phillips curve, which posits a concrete relationship between unemployment and inflation (as unemployment rises, inflation falls and vice versa).

As I reported beforehand, although, it is a mechanistic strategy that harks again to pre-Despair coverage, when working women and men had been thought to be simply one other financial enter and downturns had been valued as crucial drugs to protect the monetary well-being of the bondholding class.

It was the period when the prescription for an financial downturn provided by Treasury Secretary Andrew Mellon, one of many richest males in America, was “liquidate labor, liquidate shares, liquidate the farmers, liquidate actual property,” as Herbert Hoover described Mellon’s argument in his personal memoirs.

There’s motive to doubt that the connection applies to at the moment’s number of inflation, which has been generated by elements corresponding to pandemic-related provide chain obstacles and an aggressive enlargement of company earnings. The Phillips curve additionally is determined by an correct studying of unemployment.

As Ghilarducci observes, the revealed unemployment price of three.7% could also be artificially low as a result of it doesn’t account for employees who should be saved out of the workforce by lengthy COVID. As their sickness abates, they might come flooding again into the workforce — a “massive reserve military of labor,” as she calls it, indicating that the market isn’t almost as tight because the Fed believes.

In any occasion, the truth that wage development has lagged behind value inflation means that the primary can’t be driving inflation larger — if something, it’s holding inflation down.

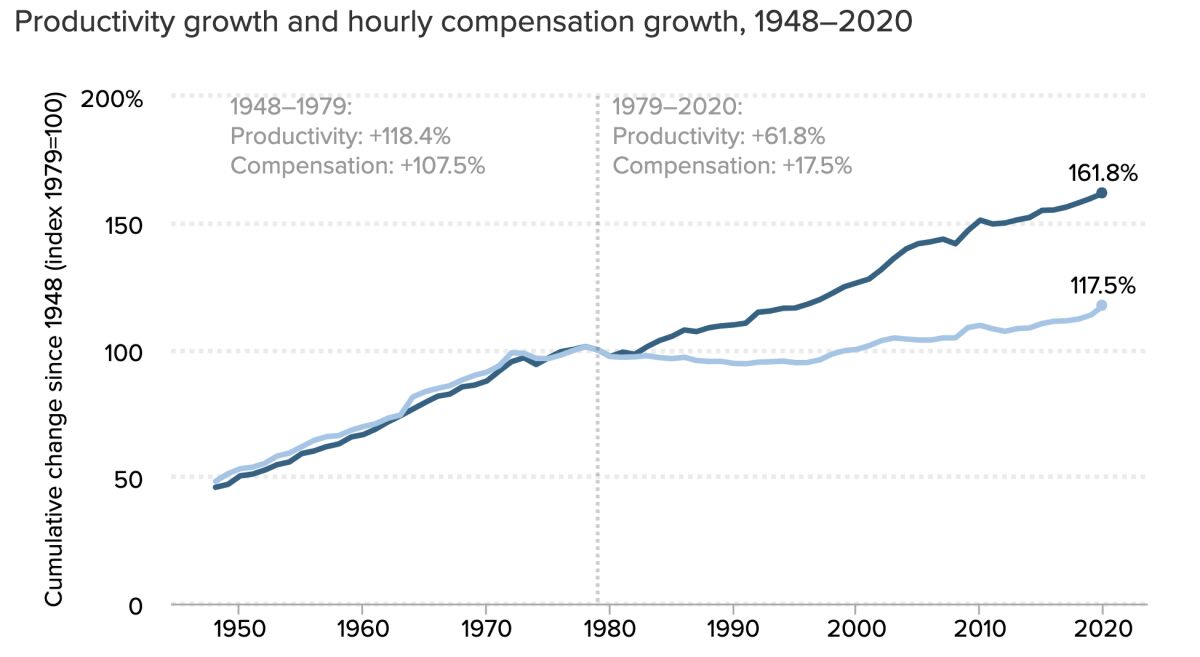

The inadequacy of wage development is proven by two different elements. One is the disconnect between productiveness development and wage development. The 2 elements marched alongside collectively from 1948 till 1979, because the labor-oriented Financial Coverage Institute has proven. Since then, the hole between them has grown: From 1979 by 2020, U.S. productiveness superior by 61.8%, however common wages grew by solely 17.5%.

Productiveness development (darkish blue) and wage development (mild blue) started to diverge in 1979, and the hole has widened ever since then.

(Financial Coverage Institute)

The second issue is the worth of the federal minimal wage, which peaked in 1970 at an inflation-adjusted $12.04 per hour (in 2022 {dollars}). At the moment it’s mired at $7.75, the place it was set in 2009.

One other development value inspecting is labor’s share of nationwide revenue in contrast with company earnings (that are upstreamed to executives and shareholders). Since 1994, company earnings have grown sevenfold whereas the labor share has been stagnant. Because the pandemic took maintain within the first half of 2020, company earnings have doubled whereas labor has misplaced floor.

It’s correct to notice that white-collar employees gained vital freedoms because of the pandemic, together with the health-giving capability to make money working from home, whereas the laboring class — these so-called important employees — had been compelled to report back to work at eating places and retail shops, at nice danger to their well being. It’s these extra privileged employees, nonetheless, who are actually going through extra stress, even mandates, to work from the workplace and figuratively punch the clock.

The union activism that has introduced illustration to employees at 234 Starbucks places in 36 states and the District of Columbia this 12 months is definitely encouraging, however it’s a piece in progress. The corporate owns 9,000 shops nationally. Furthermore, the corporate has resisted cooperating on the essential subsequent step, which is negotiating contracts with these organized employees.

To this point, negotiations have been underway at solely three places, though the corporate mentioned Monday that it’s prepared to open negotiations subsequent month in any respect the unionized shops.

The Starbucks victories are overshadowed by the long-term decline of union illustration within the U.S., which continued by the pandemic. Union membership shrank in 2021 to 14 million, down by 241,000 from the 12 months earlier than, with the share of union-represented employees falling to 10.3%. In 1983, when the federal government began gathering statistics, the U.S. had 17.7 million unionized employees, 20.1% of the workforce.

As unions wrestle to retain their collective energy, mergers amongst employers outpace them, decreasing the choices for employees searching for to maneuver to new jobs and strengthening employers’ energy.

The reality is that employee energy can’t develop except it’s abetted by authorities oversight. Regulation of labor and office security practices has been stifled through the years.

“In recent times,” the Treasury Division noticed in a March report, “the likelihood of a agency being inspected has decreased sharply.” The federal government’s Occupational Security and Well being Administration, for instance, carried out 140,000 inspections in 1984; by 2019, the quantity had fallen to 81,000, and declined additional throughout the pandemic.

Solely lately, with new regulatory initiatives by the uniquely pro-union Biden administration, has oversight of working situations and union organizing drives by the Division of Labor and the Nationwide Labor Relations Board improved.

Regardless of the truth on the bottom, the Federal Reserve, which has extra energy than some other American establishment to information the course of the U.S. economic system, continues to be wringing its fingers over indicators that demand for employees is “considerably exceeding the provision of obtainable employees,” as Powell put it on Sept. 21. He took that as an indication that the labor market is so tight that wages will likely be compelled larger.

The Fed’s drugs is geared toward decreasing that imbalance by slowing the economic system, thereby decreasing demand for employees and thus the latters’ capability to get better the bottom they’ve misplaced in an economic system that has been wholly favorable to employers for some 40 years.

Powell says his goal is to “set the stage for attaining most employment and steady costs over the longer run.” Working people who find themselves nonetheless struggling to meet the dream of a middle-class existence that has been the American promise for the reason that Forties would possibly nicely wonder if Dr. Powell’s treatment will likely be worse than the illness.